All taxpayers should review their federal withholding each year to make sure they’re not having too little or too much tax withheld. Doing this now can help protect against facing an unexpected tax bill or penalty in 2023. The sooner taxpayers check their withholding, the easier it is to get the right amount of tax withheld.

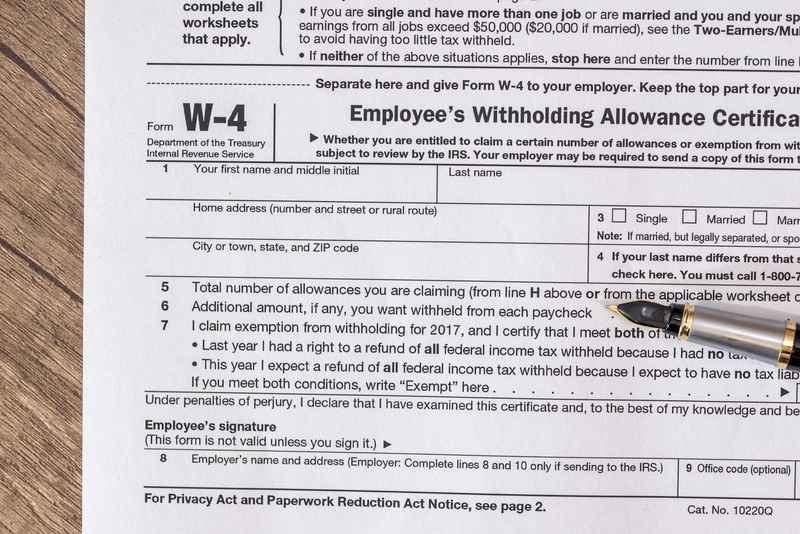

Taxpayers whose employers withhold federal income tax from their paycheck can use the IRS Tax Withholding Estimator to help decide if they should make a change to their withholding. This online tool guides users through the process of checking their withholding to help determine the right amount to withhold for their personal situation. Taxpayers can check with their employer to update their withholding or submit a new Form W-4, Employee’s Withholding Certificate.

Adjustments to withholding

Individuals should generally increase withholding if they hold more than one job at a time or have income from sources not subject to withholding. If they don’t make any changes, they may owe additional tax and possibly penalties when filing their tax return.

Individuals should generally decrease their withholding if they qualify for income tax credits or deductions other than the basic standard deduction.

Either way, those who need to adjust their withholding must prepare a new Form W-4, Employee’s Withholding Certificate. They need to submit the new Form W-4 to their employer as soon as possible since withholding occurs throughout the year.

Individuals who should check their withholding include those:

- who experienced a marriage, divorce, birth or adoption of child, purchase of a new home or retirement

- who are working two or more jobs at the same time or who only work for part of the year

- who claim credits such as the child tax credit

- with dependents age 17 or older

- who itemized deductions on prior year returns

- with other personal and financial changes

Tax Withholding Estimator benefits

The IRS Tax Withholding Estimator can help taxpayers:

- determine if they should complete a new Form W-4.

- know what information to put on a new Form W-4.

- save time because the tool completes the form worksheets.

Taxpayers should prepare before using the Tax Withholding Estimator by having their most recent pay statements, information for other income sources and their most recent income tax return. The tool does not ask for sensitive information such as name, Social Security number, address, or bank account numbers.

Taxpayers shouldn’t use the Tax Withholding Estimator if:

- They have a pension but not a job. They should estimate their tax withholding with the new Form W-4P.

- They have nonresident alien status. They should use Notice 1392, Supplement Form W-4 Instructions for Nonresident Aliens.

- Their tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.