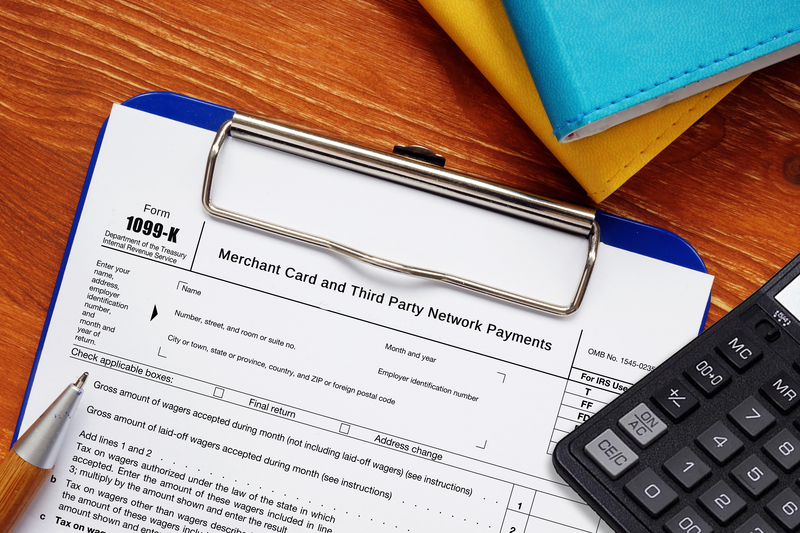

The IRS is planning to bring important changes to Form 1099-K filings. Prior to this update, the IRS required each payment settlement entity (PSE), aka credit card processing companies, to send Form 1099-K to both the IRS and the recipient (or customer) if the PSE has processed payments amounting to at least $20,000 and at least 200 transactions per customer in the previous year.

However, this update lowers the 1099-K threshold amount from $20,000 to $600 AND removes the transaction limit. This law will become effective in 2022. That means that virtually all businesses will be receiving a Form 1099-K which reports the amount of monthly credit card sales made by each company along with the total credit card sales for the year.