The Treasury Department and the IRS have just released additional guidance on the tax treatment of forgiveness of Paycheck Protection Program (PPP) loans authorized by the Coronavirus Aid, Relief and Economic Security (CARES) Act. But is it enough? The CARES Act says PPP loans may be forgiven without any tax consequences. The new ruling and accompanying revenue procedure follow up … Read More

IRS urged to stop sending notices for unpaid taxes until it catches up on mail backlog

The House Ways and Means Committee is asking the Internal Revenue Service to quit mailing notices for unpaid taxes to taxpayers who may have been affected by the mail backlog at the agency due to the COVID-19 pandemic. Many taxpayers have been receiving balance-due notices from the IRS even though they sent in their tax payments to the IRS months … Read More

One more IRS refund

13.9M taxpayers will get interest on their refunds The IRS is required to add interest to tax refunds on timely filed refund claims issued more than 45 days after the return due date. The Internal Revenue Service plans to send interest payments averaging $18 to approximately 13.9 million individual taxpayers who filed their 2019 federal income tax returns on time … Read More

Obligations for Gig Economy Workers

Educating gig economy workers on their obligations is a goal of the IRS. Many individuals who take on freelance gigs from online sites or rent out their homes or rooms through a website or app do not receive a W -2 or 1099 for their work. Some are unaware that their income is taxable or, depending on the circumstances, that … Read More

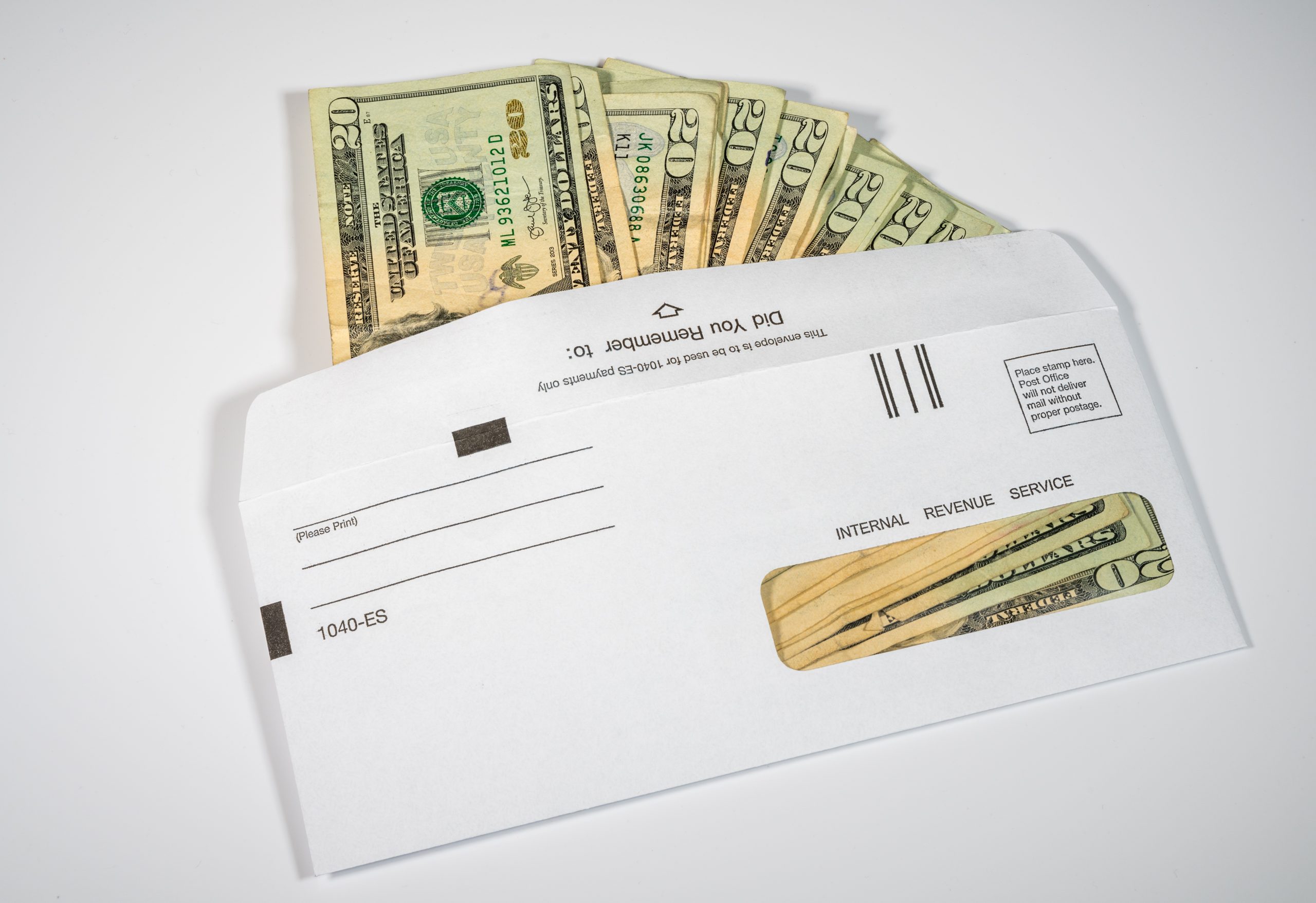

IRS UPDATE: 2nd QUARTERLY ESTIMATED TAX PAYMENT POSTPONED

On March 21, the IRS officially announced that it was extending the deadline for filing 2019 tax returns and paying any required tax from April 15 to July 15, along with the due date for the first quarterly installment of estimated tax for 2020. But it didn’t say anything about the second quarter, until now. The IRS is setting the … Read More

Common Mistakes Taxpayers are making and how to avoid them

It’s no surprise that many taxpayers are making mistakes including missing or inaccurate Social Security numbers, misspelled names, wrong filing statuses, math errors, and incorrect bank account numbers when giving their information to their preparer. Outside of Utah, clients still misunderstand that although they might not be able to itemize deductions for IRS purposes, they still might be able to … Read More

IRS not processing paper tax returns due to coronavirus

The Internal Revenue Service has stopped processing paper tax returns, with much of its staff now working remotely because of the novel coronavirus pandemic, and is encouraging taxpayers to file their taxes electronically during the three-month extension period for this year’s tax season. The IRS said Friday that to protect the public and its own employees, and in compliance with … Read More

IRS will allow coronavirus stimulus payments for seniors who don’t file tax returns

The IRS has cleared up some confusion regarding senior citizens’ stimulus payments, as a result of a contradiction between the IRS website and the language of the CARES Act about whether or not a “simple tax return” will need to be filed. It has been clarified that seniors will not need to file tax returns to receive a stimulus … Read More

Utah Tax Filing Deadline Extended

After consulting with the Governor, the President of the Senate and the Speaker of the house, the Utah State Tax Commission intends to extend the Tax Filing Deadline to July 15 to follow the federal government’s tax filing and payment action in response to COVID-19. For more information about the IRS decision to extend tax day to July 15th without … Read More

IRS Proposes New Rules for Deducting Meals and Entertainment

The Internal Revenue Service has released a set of proposed regulations for businesses to follow when deducting meals and entertainment, in response to the 2017 tax overhaul. The Tax Cuts and Jobs Act got rid of the deduction for any expenses related to activities typically considered to be for entertainment, amusement or recreation. It also restricted the deduction for expenses related to … Read More

- Page 1 of 2

- 1

- 2